from the Taxpayers’ Union

What a day! In what is probably the fastest backdown in the history of backdowns, Revenue Minister David Parker has just announced that he is pulling the pin on the Government’s proposed “Super Tax” on Kiwisaver and managed retirement funds!

The hundred billion dollar back down

The news came through as the staff were literally going through draft designs for full-page nationwide newspaper ads pencilled in for tomorrow.

What’s incredible is that Ministers were across the media all morning defending the policy – they were clearly well briefed and knew exactly what they were proposing. But by this afternoon the writing was on the wall. Minister Parker was forced into a swift U-Turn following widespread opposition.

This Government is student politics disorganisation but at a national level.

In Parliament today, the Prime Minister claimed that the GST change has been in the pipeline for years, but we keep a very close eye on IRD’s tax consultation papers – and let me tell you this proposal came from nowhere.

This Government’s fiscal management and wasteful spending is out of control. Grant Robertson, David Parker and Jacinda Ardern are desperate to paper over their fiscal holes with your money. That’s why a strong Taxpayers’ Union is so important right now.

David Farrar, Taxpayers’ Union

PS – no time for celebration, the team are back to work! In addition to Stop Three Waters campaign, tomorrow we are releasing the 2022 edition of “Ratepayers’ Report” local government league tables. Keep an eye on your inbox to see how your local council compares.

(Below is the original statement sent earlier)

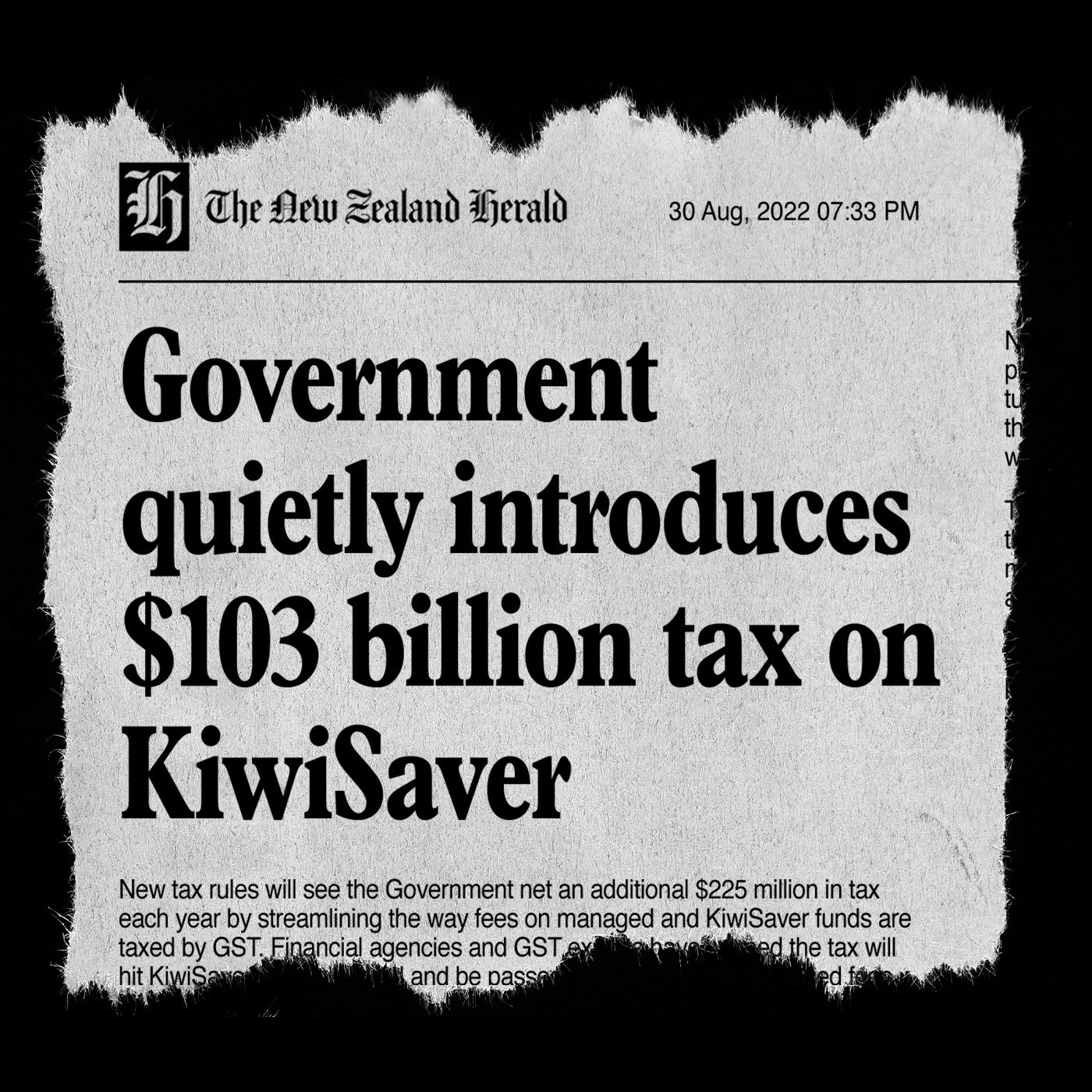

Have you seen the news this morning? Grant Robertson, Jacinda Ardern, and David Parker are coming for your retirement fund with a new tax.

Make no mistake Margaret, this proposed change to GST is the most significant and sneaky introduction of a new tax we have ever seen. It is clearly an attempt to paper over the financial mismanagement of Grant Robertson and the explosion of Government spending in the last few years.

The tax hits the very thing New Zealand needs more of: savings and investment. That’s why we need to step up and launch a campaign to force the Government to Axe this Super Tax.

So much for ‘No New Taxes’ – a raid on Margaret Stevenson-Wright’s retirement fund

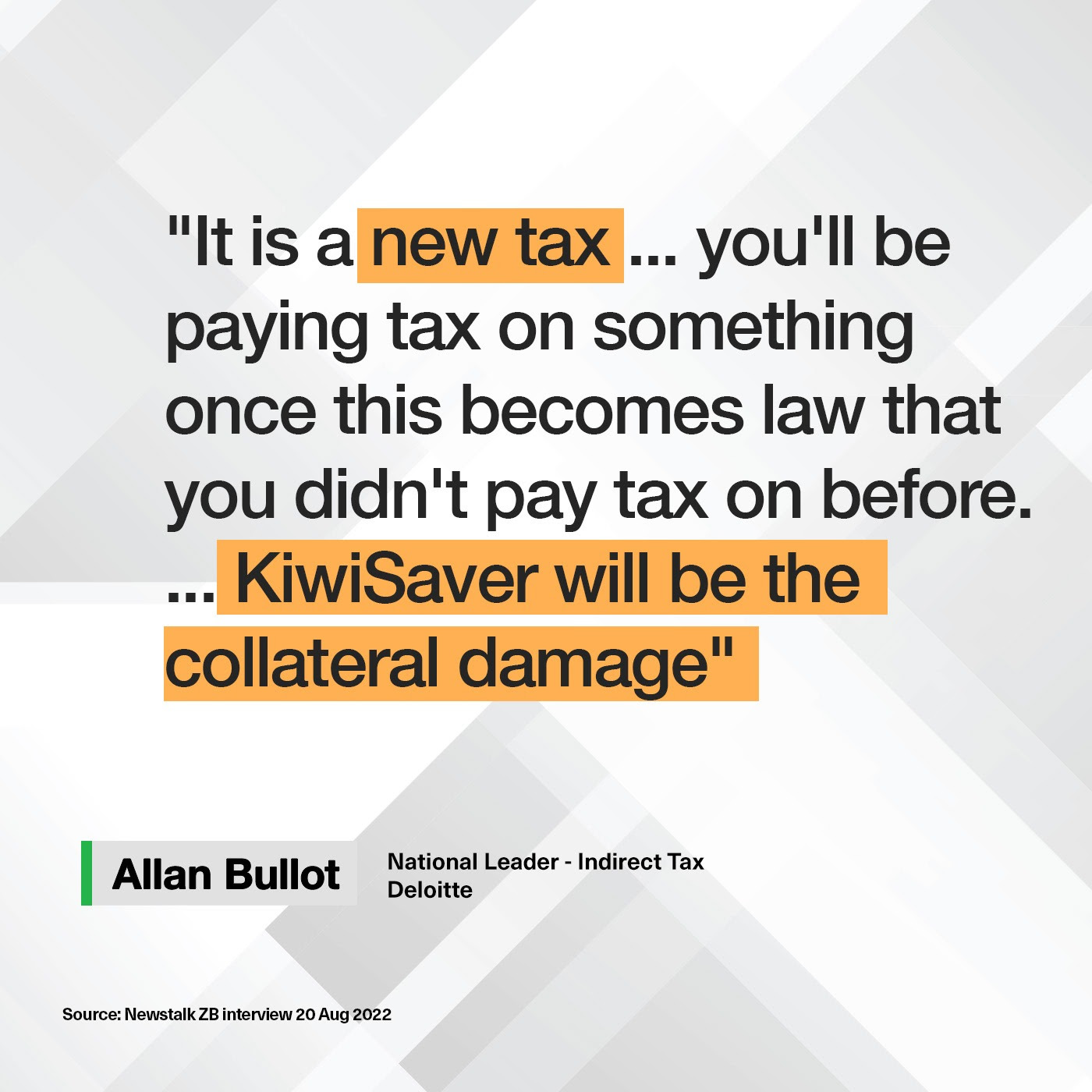

This tax came from nowhere. The Government has snuck it into an administrative taxation bill. But as the Tax Partner at Deloitte told NewsTalk ZB, this is a new tax that treats KiwiSaver (and all other managed funds!) as ‘collateral damage’. It directs funds from savers into the Government’s pocket.

The numbers are eyewatering

The Financial Markets Authority says this new tax, and its compounding effects will dent retirement funds by $186 billion by 2070.

That’s the equivalent of more than half the size of New Zealand’s entire economy this year. Remember, even small annual changes in taxes applicable to savings compound into thousand-dollar fees. That’s what makes this new tax so nasty, and economically destructive.

Someone with a $100,000 Kiwisaver fund being charged a 1% fee will them lose $21,000 to Grant Robertson’s Super Tax over the next 25 years.

We’ve won against this Government before, and we can do it again – but we’re counting on your support

Margaret, the Taxpayers’ Union has beaten this Government repeatedly on early attempts to introduce new taxes. In 2019, our “Axe This Tax” campaign defeated the proposed capital gains tax. Earlier this year, we forced the Government to cut fuel excise tax in response to the cost-of-living crisis.

The “STUFFERS” and other fake news, like the NZ Ferald, will be devastated at the amount they will lose from the advertising that they now won’t get. Couldn’t happen to a more deserving bunch, but I imagine Jasinister will find another way to “bribe” them.

The closer the next election, the more intense the MSM propaganda in support of the Jacinda government will get.

Old Geogre Carlin was not wrong …..”You know what they want? They want obedient workers. Obedient workers, people who are just smart enough to run the machines and do the paperwork. And just dumb enough to passively accept all these increasingly shitty jobs with the lower pay, the longer hours, the reduced benefits, the end of overtime and vanishing pension that disappears the minute you go to collect it, and now they’re coming for your Social Security money. They want your retirement money. They want it back so they can give it to their criminal friends on Wall Street, and you know something? They’ll get it. They’ll get it all from you sooner or later cause they own this fucking place! It’s a big club, and you ain’t in it! You, and I, are not in the big club……”

David Parker is a sick man. With punters eyes 👁👁👀.